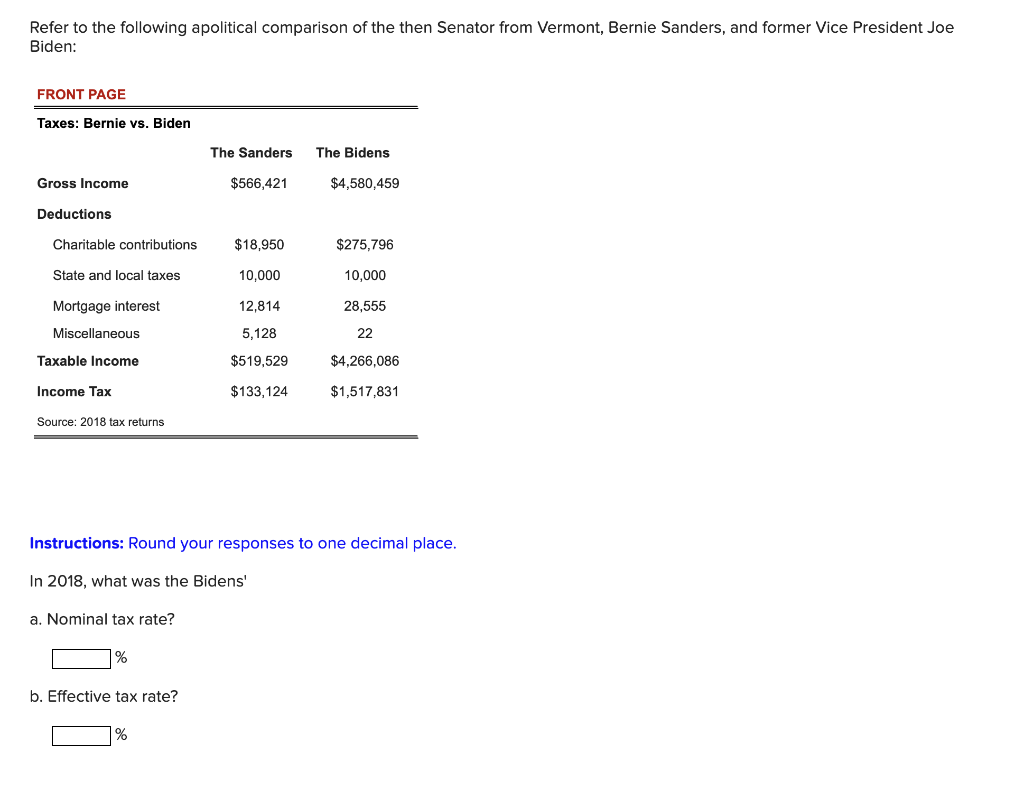

vermont income tax brackets

GB-1210 - 2022 Income Tax Withholding Instructions Tables and Charts. Tax Bracket Single Tax Bracket Couple Marginal Tax Rate.

Vermont Has The Capacity To Avoid 2016 Budget Cuts Public Assets Institute

2019 VT Tax Tables.

. Tax Rates and Charts. Multiply the result 7000. 40510001 - and above.

4 rows Vermont Income Tax Rate 2020 - 2021. Tax Year 2021 Personal Income Tax - VT Rate Schedules. Vermont Income Taxes.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Tax Rates and Charts. At Least But Less Single Married Married Head of Than filing filing house- jointly sepa- hold rately.

2019 VT Rate Schedules. 2020 Vermont Tax Deduction Amounts Tax. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of.

Tax Bracket Tax Rate. Vermont state income tax rate table for the 2020 - 2021. Base Tax is 2727.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. RateSched-2021pdf 3251 KB File Format. Then your Vermont Tax is.

This column also applies to qualifying widower and civil union. Small Farm Corporation - Minimum tax of 75 see 32 VSA. Rates range from 335 to 875.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. VT Taxable Income is 82000 Form IN-111 Line 7. 4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax.

Here you can find how your Vermont based income is taxed at different rates within the given tax brackets. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. Any sales tax that is collected belongs to the state and does.

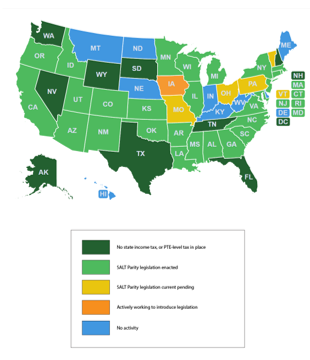

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. For tax years prior to 2012 the minimum tax for every tax year whether 12 months or a short period is 250. Vermont State Single Filer Personal Income Tax Rates and Thresholds in 2022.

Filing Status is Married Filing Jointly. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. GB-1210 - 2022 Income Tax Withholding Instructions Tables and Charts.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Tuesday January 25 2022 - 1200. 2020 Income Tax Withholding Instructions Tables and Charts.

Subtract 75000 from 82000. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Filing A Vermont Income Tax Return Things To Know Credit Karma

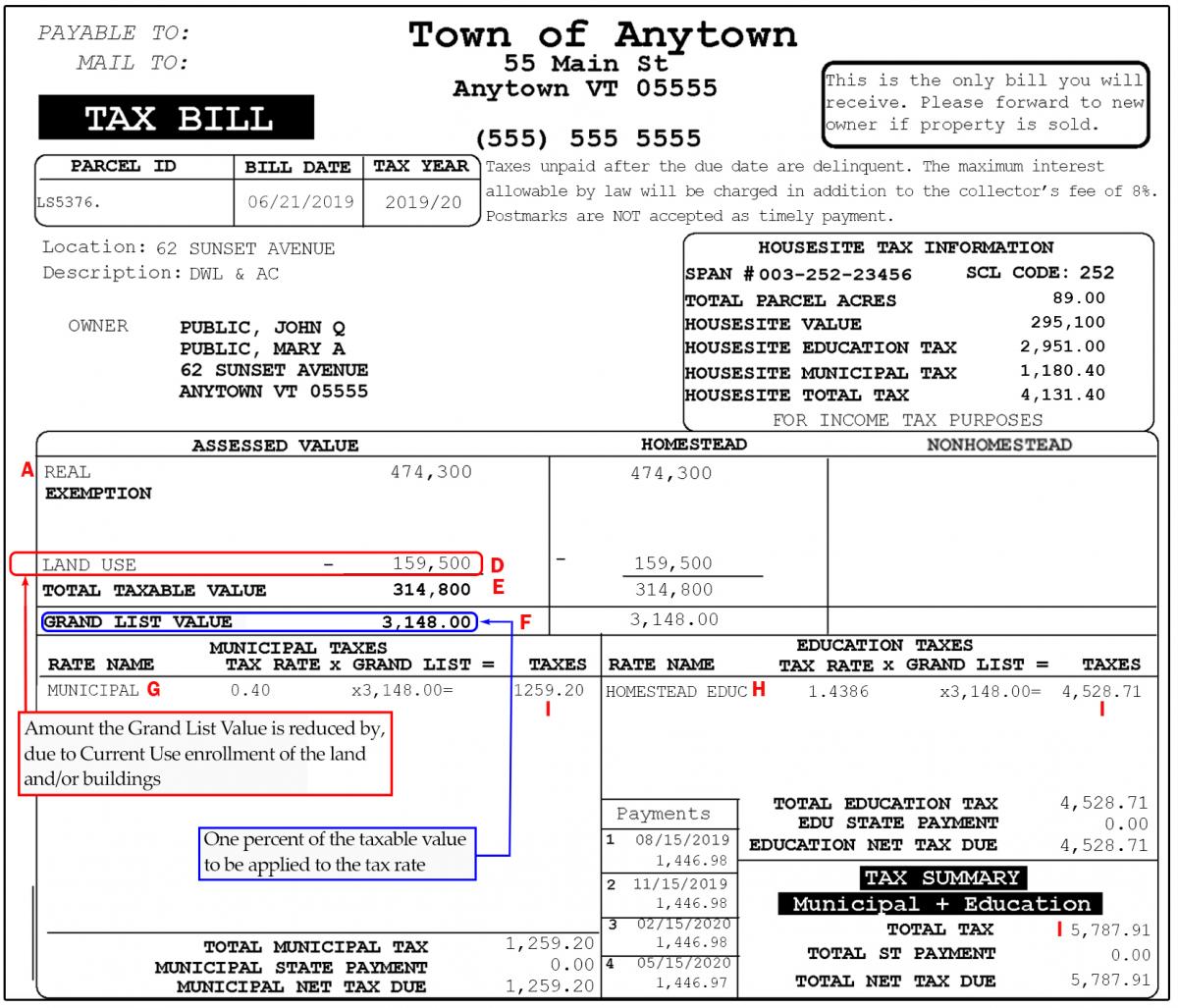

Current Use And Your Property Tax Bill Department Of Taxes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

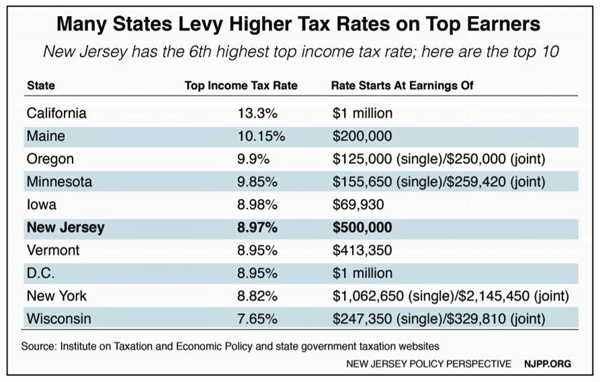

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

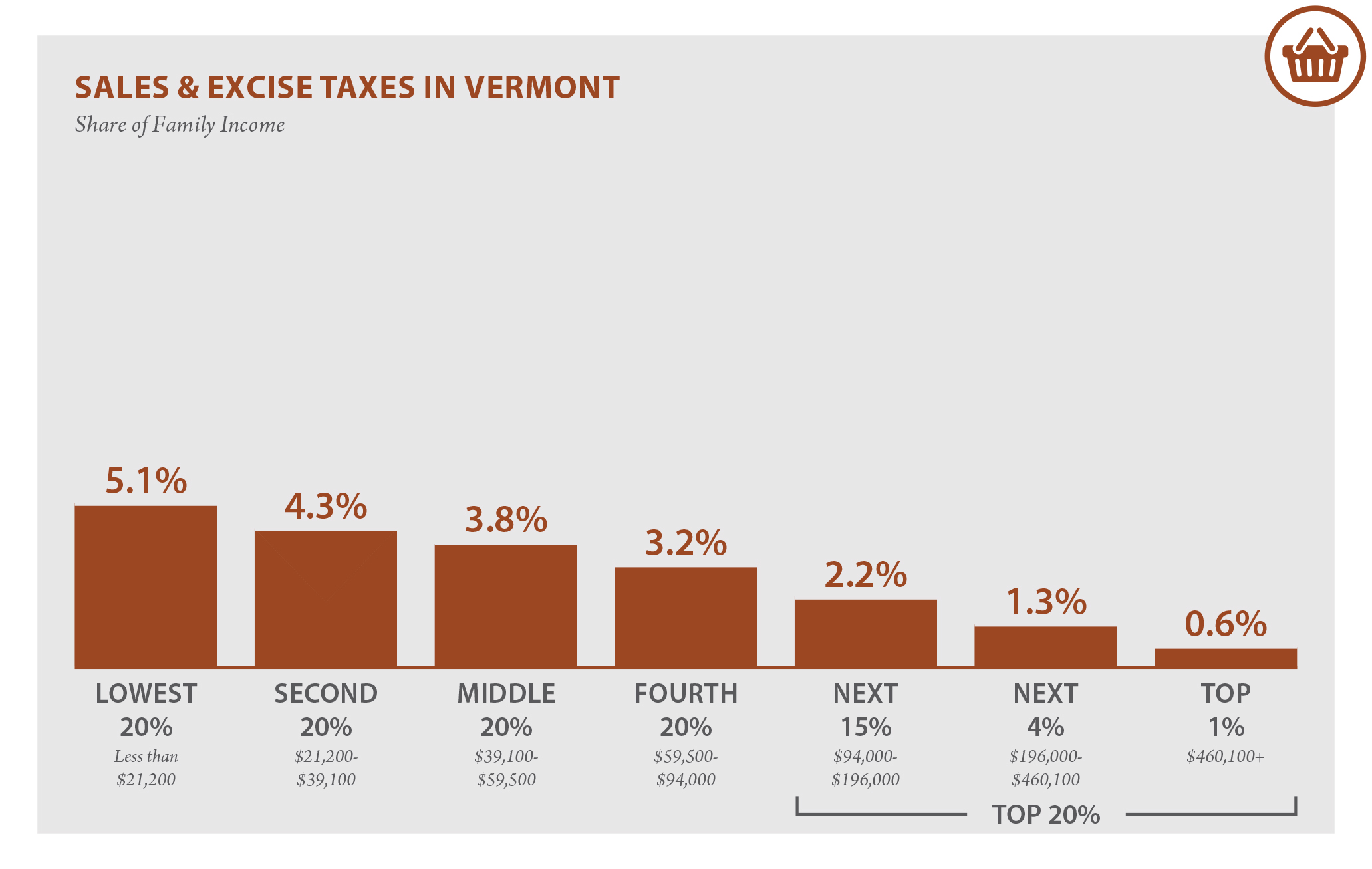

Vermont Who Pays 6th Edition Itep

Vermont Sales Tax Small Business Guide Truic

Can Vermont Follow New Hampshire S Tax Rate Reduction

![]()

Vermont Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

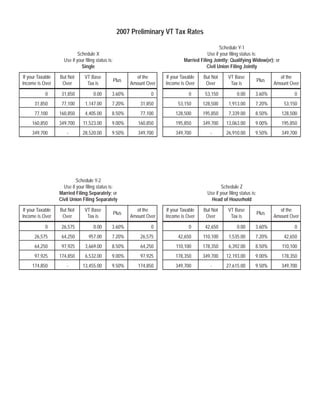

Solved Refer To The Following Apolitical Comparison Of The Chegg Com

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Llc Tax Structure Classification Of Llc Taxes To Be Paid

In 151 Extension Of Time To File Vt Individual Income Tax Return

State Income Tax Brackets Charted Tax Foundation Of Hawaii

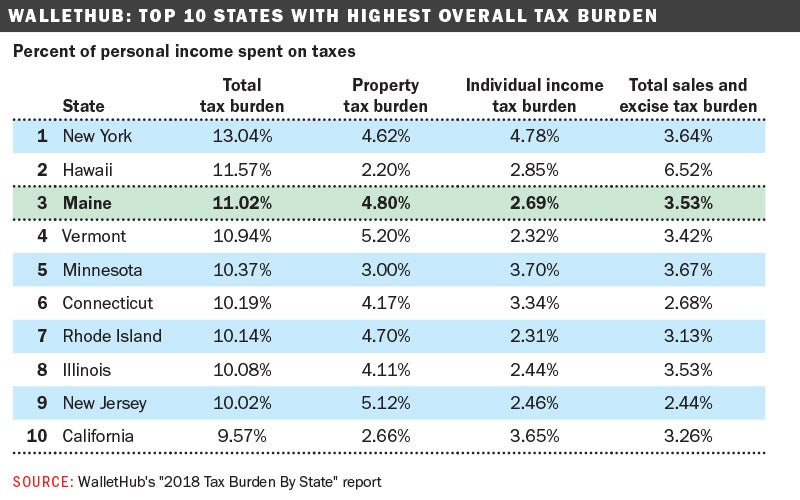

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont Income Tax Vt State Tax Calculator Community Tax

Pai Vermont School Funding Questions Answered Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation